Let's say you've decided to start looking for a house. According to the latest report from the National Association of Realtors, home sales hit an eight-year high in September—up 12 percent year-over-year, with more than 5 million homes sold during that period. With interest rates still at relatively low levels, now may be a good time to purchase a home, but if you're going to do it, you need a mortgage loan. Here's what you need to know about getting one.

1) Find out whether or not you're ready for a mortgage loan. Before checking with your bank, decide on the monthly payment amount that will be affordable for you—and make sure you can qualify for it. If the house is your primary residence, you'll typically need to put down 20 percent of the purchase price, but if you're buying a second home or investment property, some lenders will let you borrow with only 10 percent down.

2) Shop around for the best interest rates and fees. The type of loan you choose—an adjustable rate mortgage, say, versus a 30-year fixed-rate one—will affect your monthly payment. But it will also influence the interest rate you're charged. And if the loan terms are too good to be true, they probably are, so investigate what's behind them. You'll need to pay up front for certain services, like title insurance (which protects you in case someone else claims ownership of the property) and the appraisal (a document that establishes the value of the home), so ask about those costs, too.

3) Gather your most important documents. You'll need tax returns for the past two years, employment verification, bank statements for your checking and savings accounts, a credit report, and a letter from your employer stating the length of your employment.

4) Take a home-buying course. You should aim to complete an eight-hour class that will prepare you for homeownership before you meet with the loan officer at the bank. The National Consumer Law Center sponsors one free online course.

5) Meet with a loan officer at your bank or credit union. He or she will review your financial information and provide you with an estimate of the cost of borrowing, including closing costs, prepaid fees (like homeowners insurance), discount points (down payment money that's paid up front), title fees, taxes, mortgage interest, and escrow (money that goes toward property taxes and home insurance).

6) Find out about government-assisted loans. Applying for a loan through the Federal Housing Administration may help you qualify for a lower rate. The Department of Veterans Affairs, meanwhile, guarantees loans made to veterans and active military personnel. And if you fall into eligible categories under the Home Affordable Refinance Program, you may be able to refinance your current mortgage at a lower rate.

7) Get an appraisal. An appraiser who is certified by the American Society of Home Inspectors will inspect the home and provide a report on its value within 48 hours. The lender needs this document to finalize your loan agreement. If the appraisal is less than the purchase price, you'll be required to put down a larger deposit, in order to avoid a shortfall.

8) Get a home inspection. After your offer on a property is accepted, hire an inspector who's certified by the American Society of Home Inspectors or National Association of Certified Home Inspectors to look over the wiring, plumbing, and other features of the home. The report will indicate whether there are any major problems with the house, so you can renegotiate or back out of a deal if necessary.

9) Arrange for homeowners insurance. A home insurer will contact your lender to get an authorization number saying that the lender is liable for claims made under this policy.

10) Close. On the day of closing, you'll sign forms authorizing the lender to pay various fees associated with the loan. You'll typically receive a copy of your mortgage agreement in addition to a homeowners insurance policy and escrow statement indicating how much money is being held in reserve for property taxes and home insurance. The title company will then disburse the money that's owed to your real estate agent, inspector, lender, and others involved in the closing.

The first step of applying for a mortgage loan is to fill out a loan application, which includes providing information regarding your employment status, income from all sources, and other personal data that may help determine your creditworthiness. If you have been employed at the same place for over two years with an income that exceeds the monthly housing payment that you will require, you are likely to be approved for a loan.

The next step is for your lender to perform a credit check on you. This step assesses your ability to repay the loan and helps lenders determine if they should offer you their best rates or terms. If your credit score is low, it would be in your best interest to seek out a loan officer with smaller lending institutions since they are more likely to offer you financing options even if your credit score is 550.

Once you have finished the formalities of applying for a mortgage loan, you will have to wait until your loan is approved. However, it usually takes a few days for the process of approval to be completed so in the meantime, take some time to add any renovations or improvements that may add value to your home.

Once the lender finishes their evaluation process, they will be able to give you an offer that varies depending on the current market rates and your credit score. If the offer is within your budget, then it's time for you to sign the contract so your lender can proceed with finalizing the loan.

Finally, once all of the details of your loan have been finalized, you will get a confirmation from your lender. In this document, you should find out the exact number of days that it will take for them to wire money into your account after placing a specific request.

Once the funds are wired in and deposited, you will be able to start making payments on your mortgage. It is important to make sure that you always pay on time and in full with the payment due date clearly stated on your loan documents.

There are a number of ways to finance a mortgage loan. Let's take a look at how it works and the differences between each type:

1) Fund Using Savings: If you have enough savings, you can use those to fund your home purchase. This is typically what happens for people who may be buying their first home or don't have access to credit. There are a lot of costs involved in buying a home such as legal fees, closing costs and down payment (which is usually 20%). With this method, the buyer gets 100% financing for the purchase of their home.

2) Conventional Loan: A conventional loan is usually made by a bank or lending institution, and is the most popular way of financing a home purchase. These loans are available to almost all borrowers, regardless of their credit history. Conventional loans offer 95% financing because lenders require the borrower to pay for private mortgage insurance (PMI). PMI protects the lender in case you default on your loan, but after a set point in time (usually between 2-3 years), you can request to have your PMI removed.

3) FHA Loan: A fha loan is also a government-backed program that allows borrowers who are unable to make a down payment the ability to buy a home with only 3.5% down. These loans are available to almost all borrowers, regardless of their credit history. Interest rates on an fha loan are typically lower than other types of loans because they offer insurance protection to lenders in case the borrower defaults on the loan.

4) VA Loan: VA stands for veterans affairs, and is another government-backed program for veterans or active members of the military. There is no down payment required to fund this loan, and borrowers are able to finance 100% of the purchase. VA loans offer low interest rates because they are backed by the US government, which means lenders take less risk in case you default on your loan.

5) Conforming Loan: A conforming loan is another type of conventional loan that meets certain guidelines set by Fannie Mae and Freddie Mac, two government-backed agencies that are the main source of conforming loans. Any loan that meets these constraints is considered a conforming loan. Conforming loans usually require 20% down payment because lenders require private mortgage insurance (PMI). PMI protects the lender in case you default on your loan, but after a set point in time (usually between 2-3 years), you can request to have your PMI removed.

6) Subprime Loan: A subprime loan is another type of conventional loan that may encourage people who don't qualify for other types of loans, or require lower credit scores. These loans typically come along with a higher interest rate.

7) Interest-Only Loan: An interest-only loan is a type of mortgage that only pays the interest owed, and your principal amount remains the same throughout the term of the loan. This can be a dangerous method to use because if something goes wrong and you lose your job, you will have to pay back the loan in full with very little time to save up the money.

8) Balloon Loan: A balloon loan is a type of mortgage that requires the borrower to pay off the remaining balance at a later date, usually between 5-10 years after closing. This means if you have a balloon payment of $1 million dollars due in 8 years, you will have to save up the full amount of the loan. Balloon loans are typically offered because they come with low interest rates, but this means if your situation changes and you lose your job, you will have to pay back a loan during a time when money is tight.

9) Interest-Only ARM: An interest only adjustable rate mortgage (ARM) is a type of mortgage that only pays the interest owed, and your principal amount remains the same throughout the term of the loan. This can be a dangerous method to use because if something goes wrong and you lose your job, you will have to pay back the loan in full with very little time to save up the money. However, you will also be paying much less interest than with a conventional loan because the interest rate is lower.

10) Negative Amortization Loan: A negative amortization loan is a type of adjustable rate mortgage (ARM) that includes a lower interest rate and higher monthly payments at first, but gradually increases over time. This means your monthly payment may be lower than usual at first, but the amount owed will continue to grow instead of decrease.

11) Cash-Out Refinance: A cash-out refinance allows you to access the equity you have built up in your home. You can use this money to fund renovations or other capital investments, pay off credit card debt or other debts, or use the money for anything else. These loans are typically offered at a higher interest rate because you are borrowing from your home equity instead of from the bank.

12) Reverse Mortgage: A reverse mortgage is a special type of loan that allows people aged 62 and older to borrow money against their home equity without having to make any monthly payments. The money that is borrowed will then be repaid when the home is sold or upon death. Reverse mortgages are typically insured by the FHA and funded either ny a lender, loan servicer, or homeowners insurance company because it can increase your risk of defaulting on your loan.

Q: What is a mortgage?

A: A mortgage, also known as a legal instrument, is a kind of contract. Parties to the agreement are called "mortgagors" and "mortgagees." The mortgagor conveys property (the collateral) to a mortgagee in exchange for money or credit. The terms of that conveyance, which may include granting the mortgagee a lien or other interest in the property, become part of a written document called the mortgage. The terms of the agreement typically require repayment within a specific time (according to an amortization schedule) such as 25 years.

Q: How do I obtain a mortgage?

A: A mortgage must be in writing and signed by the mortgagor. The agreement should include specific details such as:

- Property to be mortgaged

- Amount of loan

- Interest rate

- Term of loan (number of monthly payments)

- Method and schedule for repayment including any balloon payment or other special terms (balloon payment is a large final payment on the loan; special terms include interest only payments, negative amortization)

- Late fees (if any)

Q: What are the three types of mortgages?

A: There are three types of mortgages that differ in delivery and timing. The type you will get depends on how quickly you make your monthly payments. The three types are:

(1) normal or traditional

A bank will lend you money and charge interest until they get repaid; this is known as a "fully amortizing fixed-rate mortgage."

(2) option adjustable-rate mortgages (option ARMs or options for short)

This type of mortgage has an initial interest rate that's lower than the fully amortizing fixed-rate mortgages. This means you will make smaller monthly payments for a few years after which time your interest rate may adjust to a higher rate.

(3) balloon payment mortgages

You can borrow money with this type of mortgage, but it's likely that you will have to repay the loan in one lump sum after a specific period of time.

Q: What are subprime mortgages?

A: Subprime is the opposite of prime. Subprime loans carry more risk for lenders because they involve borrowers with poorer credit histories or without enough money for a down payment. Subprime loans are most often used to purchase property with the goal of making a quick profit (by selling it for more than what they paid for it). There is widespread agreement that lenders targeted subprime borrowers with unfair or predatory lending practices in an attempt to foreclose on properties quickly and turn them around at a profit.

Q: What is the two-step mortgage process?

A: The two-step mortgage process, also known as the "originate-to sell" model, is used by lenders to generate revenue. First, they approve loans that are then sold off to investors. Second, the investors receive payments from borrowers over time. This system has come under heavy criticism for its role in contributing to the subprime mortgage debacle that led to the financial crisis of 2007-2009.

Q: Who determines the interest rate on my loan?

A: A lender typically offers a range of interest rates depending on your creditworthiness and for how long you wish to repay the loan (that is, the term). You can choose the term you want, but if your credit is good and you need longer to repay it might be wise to take a shorter term in order to pay less interest. The lender's decisions about rates are almost exclusively determined by their cost of capital (risk-adjusted rate of return required on new money borrowed).

Loan origination is defined as the process by which a lender gathers the documentation and information required to facilitate the finalization of a mortgage loan file. Loans are either originated through correspondent channels—where lending companies use third-party originators to produce loans that will be underwritten, purchased or securitized—or direct channels , where lenders produce loans that they retain on their own books for secondary market transactions.

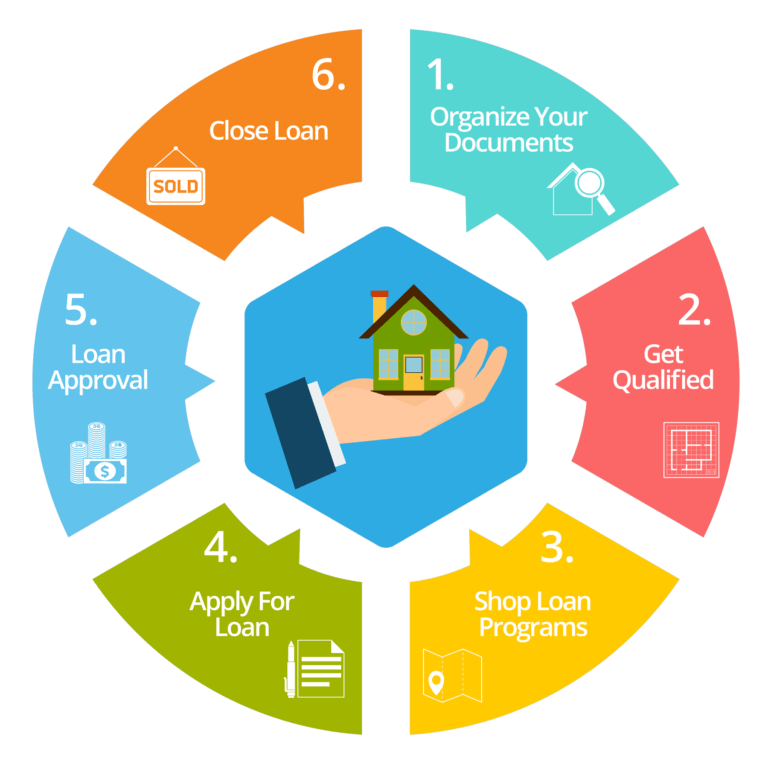

Step One: Loan Prequalification or Pre-approval

Loan prequalification and loan preapproval are the first steps in the mortgage origination process. Lenders with correspondent channels who purchase loans typically require borrowers to be prequalified before they will accept a loan application. Those with direct channels often require borrowers to be preapproved before submitting an application.

Step Two: Loan Application

Loan applications vary depending on the borrower’s needs and the type of mortgage he or she is seeking. Application forms can range from a single-page form for a simple refinancing to a multi-page form for a purchase transaction. Loan applications include the borrower’s personal information, the property address and description, estimated value, description of any construction or remodeling plans, and financial data (employment status, income, assets).

Step Three: Underwriting

The underwriter reviews the loan application to make sure all required documents are included. The underwriting process can take anywhere from one day to several weeks, depending on the complexity of the transaction and the amount of documentation the lender requires.

Step Four: Loan Approval

Once all documents are collected and reviewed by an underwriter, they are sent to a loan approver who reviews them for final approval .

Step Five: Closing

After the loan file is approved, it is sent to a closing agent who finalizes the transaction by attending a closing—or settlement—where all terms of the loan are agreed upon and signed off on . After signing the paperwork, the borrower will receive his or her copy of the executed mortgage. If applicable, the borrower will receive a final recorded copy of the mortgage .

We serve the people in the Florida communities of:

Boca Raton, Boynton Beach, Hypoluxo, Ocean Ridge, Gulf Stream, Delray Beach, Hillsborough, Pompano Beach, Leisureville, Wellington, Royal Palm Beach, Riviera Beach, Belle Glade and Most of Florida!